Pros/Cons of a Medicare Supplement

How do you know what Medicare plan is best for you? Check out this blog discussing the pros and cons of a Medicare Supplement. #WeAreHovis #MedicareMadeSimple

How do you know what Medicare plan is best for you? Check out this blog discussing the pros and cons of a Medicare Supplement. #WeAreHovis #MedicareMadeSimple

Flexible Spending Accounts and Health Savings Accounts offer employees a way to pay for some medical expenses with pre-tax dollars. Learn more about their rules and differences in this blog, the third in a series about creating a good, financial foundation. #WeAreHovis #PlanwithHovis

This blog is the second in a series about setting up a good financial foundation. We’ll discuss some rules of thumb for how much income you should save. #WeAreHovis #PlanwithHovis

What would happen to your revenue stream if you had a hardship such as a health issue, disability or had to care for someone else? 48% of American retirees leave work earlier than expected, according to new data on www.businessinsider.com.

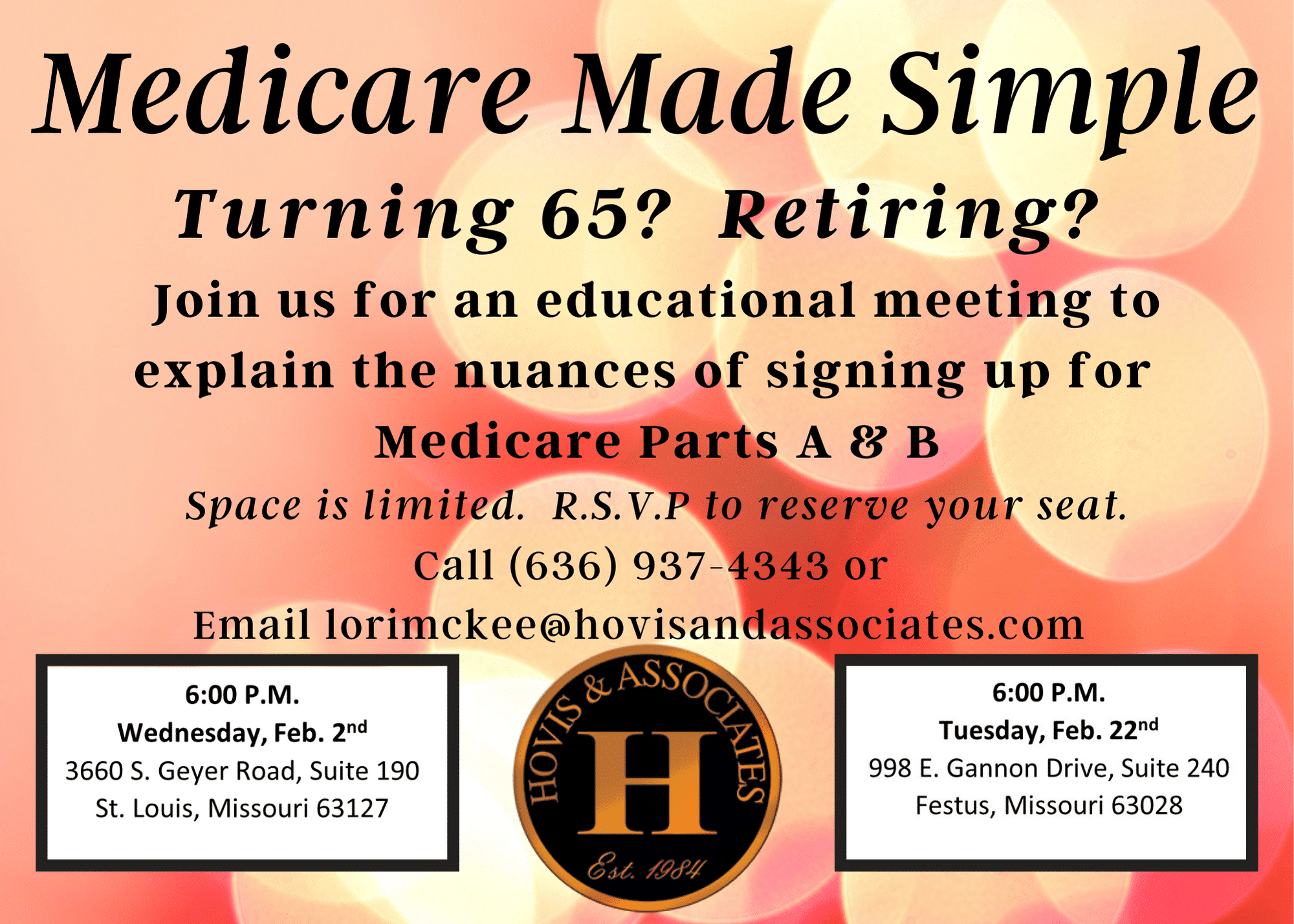

Are you turning 65 or planning to retire this year? Make sure you have all the information you need to make an informed decision and to avoid costly mistakes.

Start your new year off right by organizing your files. Our blog offers general guidelines on how long to keep different documents. #WeAreHovis #PlanwithHovis

The holidays are a perfect time to consider gifting money to your loved ones. We discuss the gift limits and strategy considerations in our blog. #WeAreHovis #PlanwithHovis

We don’t offer leads, we offer APPOINTMENTS! All appointments are conducted in FREE office space at one of our convenient Hovis & Associates’ locations. #wearehovis #hovisagent #medicaremadesimple