We’ve all been there. We wish we had done something, or not done something, and are left with regrets. Some are silly; some more serious; but each regret leaves us wanting a do-over.

Often, we get so caught up in our own lives that we forget to stop and smell the roses until something grabs us by the throat and commands our attention. A friend or loved one passes away unexpectedly, a spouse is diagnosed with a terminal disease, a co-worker is laid off.

It’s not until events like these occur that we re-evaluate our priorities and think about what is truly important in our lives. Being a type A personality, I sometimes focus on insignificant things, obsessing over every minute detail to make sure (fill in the blank) is perfect. Instead, I need to remember to stop and savor those small moments. Our children tend to drive this point home as they reach milestones in both their lives and ours as parents. I’ve blinked, and they are now teenagers. Whether my house was spotless when they were babies really didn’t matter as much as the bigger picture of enjoying time with them.

The same can be said with our finances. Are we focused on the big picture? Are we prioritizing the right things? Are we preparing for retirement, so we CAN retire? Or the flip side: are we so worried about saving money that we don’t stop to enjoy life along the way? We’ve seen clients that have experienced regrets in both ways. Some didn’t consider planning for retirement seriously or early enough, while others didn’t enjoy the fruits of their labor throughout their careers.

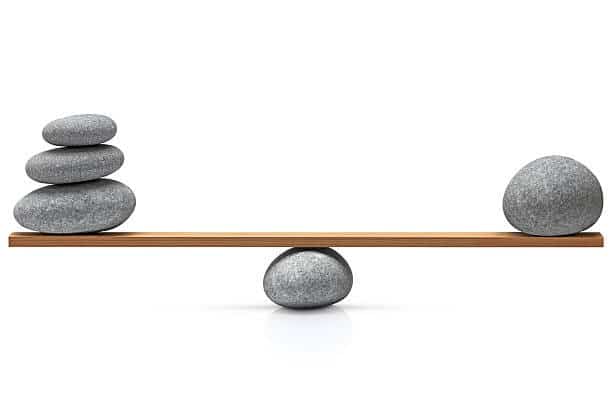

It all comes down to balance. Set some short-term and long-term goals that help you avoid having regrets. Here’s to hoping you find your balance to live your best life, free of regrets.