- Frequently

Asked

Questions - Eligible

for

Medicare? - Prescription

Drug

Plans (PDP) - Medicare

Supplements/

Medigap - Advantage Plans

(MA/MAPD) - Ancillary

(Dental, etc.)

What are the 2024 Medicare premiums, deductibles and coinsurance?

Medicare Premiums, Deductibles and Coinsurance

| Part A Inpatient Deductible | $1,632.00 |

| Inpatient Coinsurance Days 61 – 90 | $408.00 |

| Skilled Nursing Facility Days 21-100 | $204.00 |

| Part B Premium | $174.70 |

| Part B Deductible |

$240.00 |

What are the 2023 Medicare premiums, deductibles and coinsurance?

Medicare Premiums, Deductibles and Coinsurance

| Part A Inpatient Deductible | $1,600.00 |

| Inpatient Coinsurance Days 61 – 90 | $400.00 |

| Skilled Nursing Facility Days 21-100 | $200.00 |

| Part B Premium | $164.90 |

| Part B Deductible |

$226.00 |

Would I ever pay more for my Part B or Part D than others?

Yes! Since 2007, a beneficiary’s Part B monthly premium and Part D Income-Related Monthly Adjustment Amount (IRMAA) are based on his or her income reported on IRS tax returns from two years prior. The below table will be based on beneficiary’s 2022 tax returns.

2024 Part B total premiums for high income beneficiaries:

| If your yearly income in 2022 (for what you pay in 2024) was: | You Pay Each Month(in 2024): | ||

| File Individual Tax Return | File Join Tax Return | File Married & Separate Tax Return | |

| $103,000 or less | $206,000 or less | $103,000 or less | $174.70 |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | Not Applicable | $244.60 |

| above $129,001 up to $161,000 | above $258,000 up to $322,000 | Not Applicable | $349.40 |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | Not Applicable | $454.20 |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $559.00 |

| $500,000 or above | $750,000 and above | $397,000 and above | $594.00 |

2024 Part D income-related monthly adjustment amount in addition to the plan premium:

| If your filing status and yearly income in 2022 was |

You Pay Each Month (In 2022): | ||

| File Individual Tax Return | File Joint Tax Return | File Married & Single Tax Return | |

| $103,000 or less | $206,000 or less | $103,000 or less | Your plan premium |

| above $103,000 up to $129,000 | above $206,000 up to $258,000 | Not applicable | $12.90 + Your plan premium |

| above $129,000 up to $161,000 | above $258,000 up to $322,000 | Not applicable | $33.30 + Your plan premium |

| above $161,000 up to $193,000 | above $322,000 up to $386,000 | Not applicable | $53.80 + Your plan premium |

| above $193,000 and less than $500,000 | above $386,000 and less than $750,000 | above $103,000 and less than $397,000 | $74.20 + Your plan premium |

| $500,000 or above | $750,000 and above | $397,000 and above | $81.00 + Your plan premium |

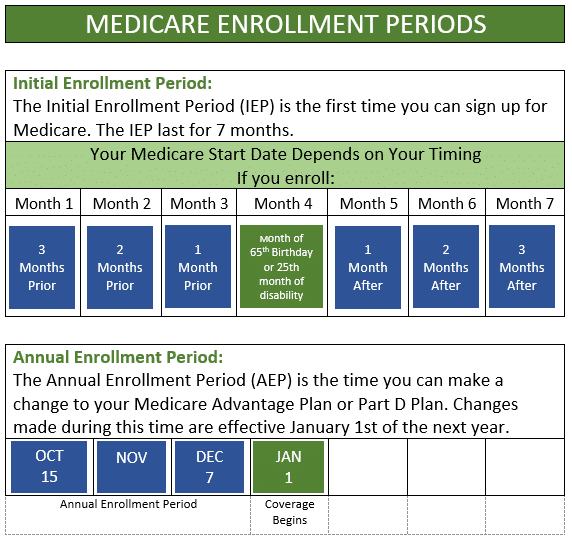

What are times I can enroll and make changes to a Medicare plan?

How do I qualify for Medicare?

You become eligible for Medicare when you turn 65 or on your 25th month of collecting Social Security Disability. If you are drawing some form of Social Security benefit (retirement or disability) and become eligible for Medicare, you will be automatically enrolled in Part A and Part B.

If you are not collecting any Social Security benefit when you become eligible for Medicare, you must enroll through Social Security for Medicare Part A and Part B by doing one of the following:

- Apply online at ssa.gov

- By phone - Call SSA 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. If you are deaf or hard of hearing, you can call TTY 1-800-325-0778.

- In person - Visit your local Social Security office. It is suggested to call and make an appointment.

Do I need Part A & B if I am still working?

Everyone’s situation is different. It all comes down to wanting to avoid late enrollment penalties. You would need to contact your employer benefits manager to find out how your current coverage works with Medicare and whether it is considered credible prescription drug coverage*. If the plan is credible you may stay on the plan, without concern of a late enrollment penalty in the future. If it is not, then it might be advantageous to enroll in Part A & B to avoid future penalties.

*Creditable prescription drug coverage are plans that offer as good or better coverage than

Medicare Part D plans offer. If you are eligible for Medicare and do not enroll in a Medicare

plan, you could be subject to a late enrollment penalty (LEP) at a later date.

Does Hovis & Associates charge a consultation fee?

Hovis & Associates does not charge a consultation fee to our clients. We are paid a commission on the policies we write by the insurance companies; therefore, we don’t have additional fees or costs for you to meet with one of our Medicare Consultants.

If I go on Medicare, what happens to my spouse's coverage?

If your spouse is currently a dependent under your employer/group plan, it is likely that they’ll lose coverage if you go onto a Medicare plan. Most of the time your spouse could extend their coverage through COBRA/Missouri Continuation for a period for time. You would need to contact your employer benefits manager to find out the plan’s guidelines.

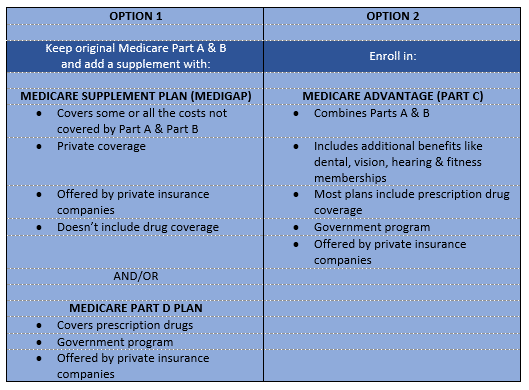

Is a Medicare Supplement Plan the same as a Medicare Advantage Plan?

No, these are different coverage options. There are two options to supplement or replace Original Medicare. One option is to purchase a Medicare Supplement (or Medigap) plan. The other option is a Medicare Advantage Plan, or Part C plan. See the chart below. You only select one option; you cannot have both.

What do I do if I can’t afford to pay for my medications?

You may be eligible to get help paying your drug costs with a program called Extra Help. This assistance is also called Part D Low-Income Subsidy or LIS. This is a Federal program that helps people with lower incomes pay for their Part D premiums and copays. You must qualify and there are different levels of help available. You can get more information at: https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/lower-prescription-costs

Why do I need a Medicare Prescription Drug (Part D) plan, if I don’t take any medications?

Medicare Part D plans assist you with your prescription drug costs. The decision to enroll in a Part D plan depends on if you already have coverage through an employer/union when you are first eligible for Medicare. If you wait to enroll in a Part D plan later than 63 days past your Initial Enrollment Period (IEP) or leave your employer coverage, you could be subject to a Late Enrollment Penalty (LEP).

When can I change my Medicare plan?

Depending on the type of plan you have, there are different times of year to make changes. Below are the most common time frames:

MEDICARE ADVANTAGE PLAN

The Annual Enrollment Period (AEP) happens annually from October 15th through December 7th. Changes made during this time are effective January 1st of the next year.

During this time, you can switch from:

Medicare Advantage Plan to another Medicare Advantage Plan

Medicare Advantage Plan back to Original Medicare

The Medicare Advantage Open Enrollment Period (OEP) happens annually from January 1st through March 31st. Changes made during this time are effective the first of the next month after you enroll.

During this time, you can switch from:

Medicare Advantage Plan to another Medicare Advantage Plan

Disenroll from your Medicare Advantage Plan and return to Original Medicare (which also allows you to join a stand-alone Prescription Drug Plan)

MEDICARE PRESCRIPTION DRUG PLAN

The Annual Enrollment Period (AEP) happens annually from October 15th through December 7th. Changes made during this time are effective January 1st of the next year.

During this time, you can switch from:

Prescription Drug Plan to another Prescription Drug Plan (PDP)

Disenroll from your PDP

*Note: If you sign-up for a new plan with Prescription Drug coverage it automatically disenrolls you from your old plan.

MEDICARE SUPPLEMENT PLAN (MEDIGAP POLICY)

You can change your Medicare Supplement on the first of any month as long as you medically qualify. However, in Missouri, you can change to a like plan on your anniversary date without having to medically qualify or answer any health questions. You can do this the month prior to your anniversary date or the month after.

How do I contact Social Security to sign up for Medicare Parts A and/or B?

- Apply online at ssa.gov (Make ssa.gov a link)

- By phone - Call SSA 1-800-772-1213 from 7 a.m. to 7 p.m. Monday through Friday. If you are deaf or hard of hearing, you can call TTY 1-800-325-0778.

- In person - Visit your local Social Security office. It is suggested to call and make an appointment.

Are You Eligible for Medicare?

IEP, or “Initial Enrollment Period” for Medicare, is a window of time provided by Centers of Medicare and Medicaid Services (CMS) to shepherd qualifying individuals safely into Medicare. If you’re a U.S. citizen or you meet the lawful presence and residency requirements, the Initial Enrollment Period (IEP) is your first chance to sign up for Medicare. During the 7-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. Your coverage will begin the first day of the month after you ask to join a plan. If you join during one of the 3 months before you turn 65, your coverage will begin the first day of the month you turn 65.

Example:

Your birthday is May 9th. You can enroll in February, March, April as the three months prior to your birthday month, in May since that is your birthday month, or in June, July, August for the three months after the month you are eligible. If your birthday falls on the first of the month, you will be able to start Medicare Coverage on the first of the previous month.

Example:

Your birthday is on May 1st. You can enroll in January, February, or March as the first three months, in April since that would be considered the month your Medicare coverage can begin, and then May, June, and July for the three months after the month you are eligible.

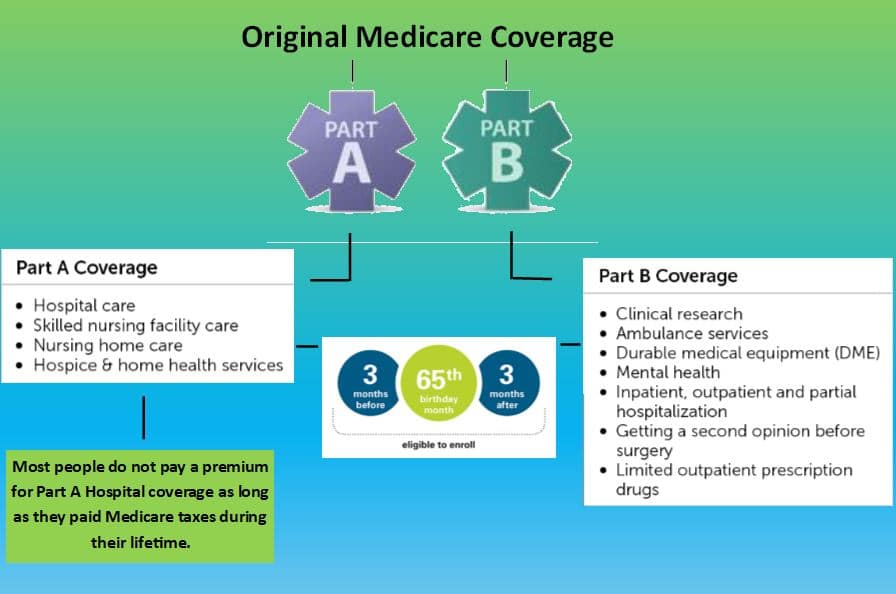

You may also be able to enroll if you are under 65 because you have a disability or special condition.

IEP offers an enrollment session to join phases A, B, C and D of the Medicare program.

- Part A is Hospital Coverage

- Part B is Medical Coverage

- Part C describes enrolling in a Medicare Advantage Plan (MAPD)

- Part D describes enrolling in some form of Medicare Prescription drug coverage.

Upon reaching the retirement age of 65 years, if you are already receiving Social Security benefits, you will be automatically signed on to Parts A & B of Medicare. If you are not drawing Social Security, you will have to sign up for Parts A & B when you are eligible.

Prescription Drug Plans

Medicare offers prescription drug coverage plans for everyone enrolled in the Medicare Program. When you first enroll into the Medicare program when you are eligible, you are expected to sign up with the Medicare Prescription Plan D. If you elect not to do so at that time, you will start incurring a 1% penalty of the national average drug plan. If you decide to join at a future date, that penalty will be calculated and then added on to your future drug plan every month for the rest of your life. You must join a drug plan run by an insurance provider or any other private plan which is approved by Medicare. There are two ways to join a Drug Prescription Plan:

- Medicare Prescription Drug Plan (Part D)—This is the original Medicare Prescription Plan, also referred to as PDPs

- Medicare Advantage Plan (Part C)—Through other Medicare Health Plans that come with a Prescription Drug Plan included as part of the package

Medicare Supplements or Medigap Policies

Medicare Supplement Insurance, also referred to as Medigap, is a policy that is offered and sold by private insurance companies which can help in the payment of some of your medical bills that may not be covered by Medicare itself. For instance, when you travel overseas, your original Medicare may not cover your bill, but some Supplemental Plans have some coverage for instance a deductible, co-insurance and then a lifetime maximum. Medigap can only supplement your original Medicare plan; hence, if Medicare does not approve or cover a procedure, it will not be covered by your Supplement Plan. To get a Medigap plan, you must have the original Medicare Parts A and B, and you must pay a private Medicare Supplemental Plan Provider specified monthly premiums.

*None of the above companies are connected with or endorsed by the United States government or the federal Medicare program.

Medicare Advantage Plans

Medicare Advantage Plans, often referred to as “Part C” or “MA/MAPD Plans,” are offered by private companies. Such offering companies must be approved by Medicare. Joining a Medicare Advantage Plan still means you have Medicare. Your Medicare is subcontracted out to the private insurance companies. The government, through Medicare, pays a specific premium to companies offering the Medicare Advantage Plan. Your prescription drug coverage (Part D) is covered through most Medicare Advantage Plans (MAPDs). Some plans (MAs) may not come with the prescription drug coverage; in few instances, you can also join a Prescription Drug Plan, which still remains an option for you. It is important to know that you cannot have prescription coverage through both a Medicare Advantage Plan and a Prescription Drug Plan, though. In order to qualify for the Medicare Advantage plan, you must apply within the correct time period and you must meet the following criteria:

- You must be enrolled in Medicare Parts A and B.

- Your Medicare rights must apply to you.

Annual Enrollment Period Begins

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

We do not offer all plans in your area. Any information we provide is based on plans we do represent in your area. We currently represent 10 organizations offering 79 plans in your area. For information on all of your options, please go to Medicare.gov, 1-800-MEDICARE, or your State Health Insurance Program.